What should you know?

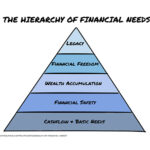

Taking control of your spending plays a key role in achieving financial stability & wellbeing.

But where do you start?

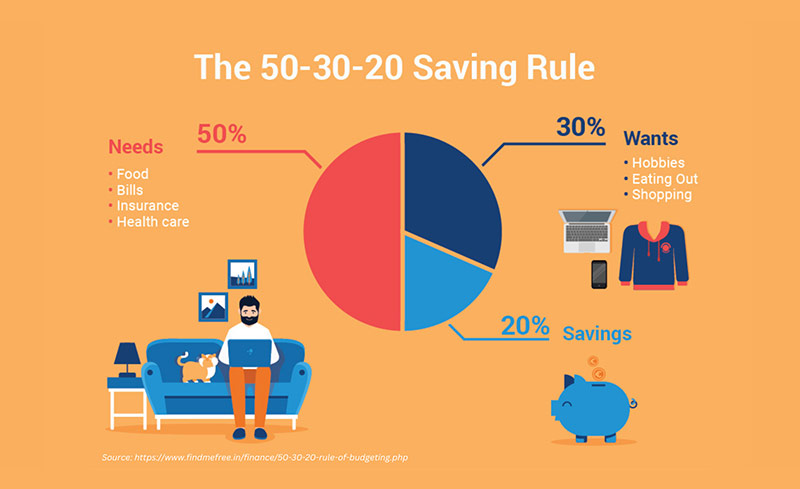

One of the most popular and straightforward methods to manage your money is the ‘50/30/20 Rule’.

This simple framework helps you manage your finances by allocating your income to three categories: needs, wants, and savings:

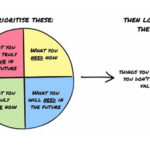

Needs (50%): These are the essential expenses that you must cover to maintain your quality of life. It includes things like rent/mortgage payments, utilities, groceries, school fees, transportation, and insurance.

Wants (30%): These are the non-essential items and experiences that make your life enjoyable. Examples include eating out, entertainment, holidays, activities, and hobbies.

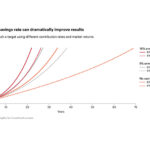

Savings (20%): This is where you secure your financial future. The savings portion should be used to build a rainy day fund, contribute to pensions, and invest towards your long-term goals.

Why should you care?

We live in a world of temptation and consumerism where you are constantly reminded of a myriad of ways that you can spend your money. Consequently, mindful spending and responsible saving can be difficult.

A framework such as the 50/30/20 rule is a great starting point to set you on a positive pathway to competently manage your money.