What should you know?

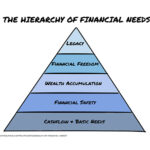

Successful investing is the combination of two defining factors, things you can control (your financial behaviour), and the things that you cannot control (the stock market, global politics, government economic policy etc).

We know that, if you are patient and remain invested for the long term, investment markets will do lot of heavy lifting by compounding the growth of your money.

However, in order to really accelerate your wealth accumulation, you need to do your part as well.

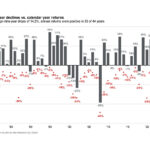

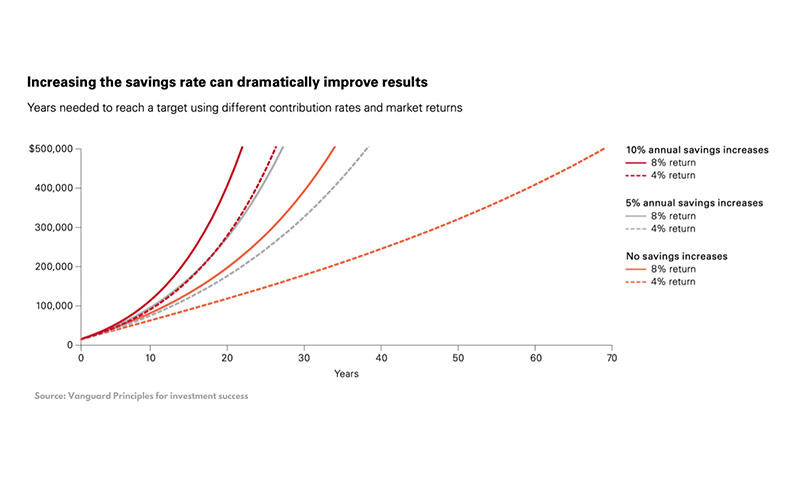

The chart below shows the time taken to reach an inflation adjusted $500,000 for an investor who invests $10,000 at the start, then adds $5,000 each year.

This is compared with the outcomes when the investor increases the annual savings amount by 5% and 10% per year:

Why should you care?

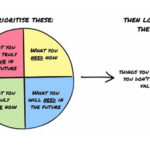

Achieving your financial goals is a two-way street. Investment markets will do their part, but how much you get out of your investments will be largely dependent on how much you put in.

As your income increases, so should your investment contributions. Try to nudge up your contributions every time you receive a pay rise. That way, your savings rate and wealth will keep pace with your lifestyle.

A reliable and robust financial plan addresses both the controllable and the non-controllable elements, ensuring behavioural returns compound on top of investment returns to take you to financial independence in the shortest time possible.