What should you know?

Investment markets do not tend to move in straight lines. This can be frustrating, especially for newer investors who may not be accustomed to volatility.

Whilst it’s impossible to reliably predict when ups and downs will occur in the future, you can prepare for what can be expected by looking to the past for guidance:

1) Global stock markets, on average, go up in 3 out of every 4 years.

Expectation: You will have negative annual returns in 1 of every 4 years, on average.

2) Every 7-8 years, on average, markets experience a deep temporary decline.

Expectation: Your investments will temporarily drop in value by -30%, or more, every 7/8 years, on average.

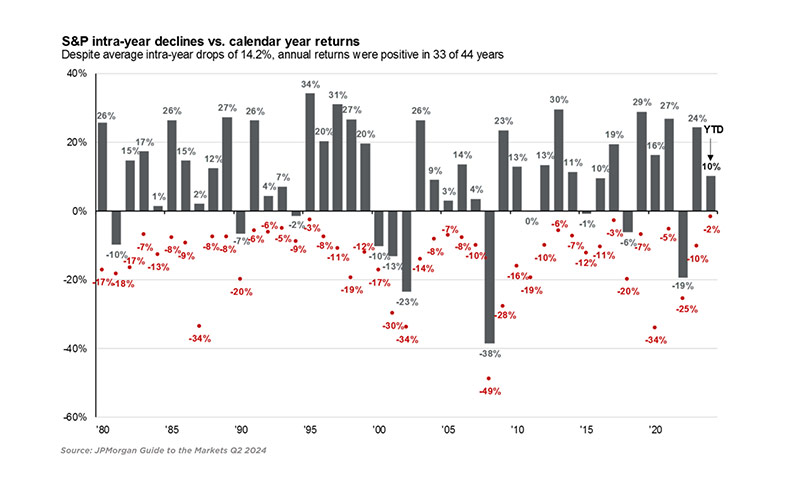

3) Within any given year there is, on average, a drop of -14.2% at some point during the year.

Expectation: Your investments will temporarily drop by around 14%, on average, in every single year, even in years that end with very strong growth.

The chart below shows the intra-year declines (red dots) and annual returns (grey bars) for the S&P 500 since 1980. Take note of how many years have BOTH big intra-year declines AND positive returns:

Despite this volatility, investing in the S&P 500 index over the same period produced average annualised returns (excluding dividends) of 10.3% for long term investors.

Why should you care?

Remaining invested through all the market’s ups and downs is an essential discipline that you must master if you want to be a successful investor.

Once you embrace that volatility is simply par for the course and not a cause for concern, your financial anxiety will reduce and your investment journey will become more comfortable.