What should you know?

As you move through life, it is common for your financial needs to evolve. You begin by dedicating 100% of your income to your basic needs. Over time, as your wealth and income grow and your more basic needs are satisfied, you progress onto more advanced considerations.

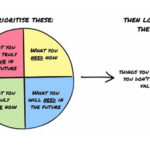

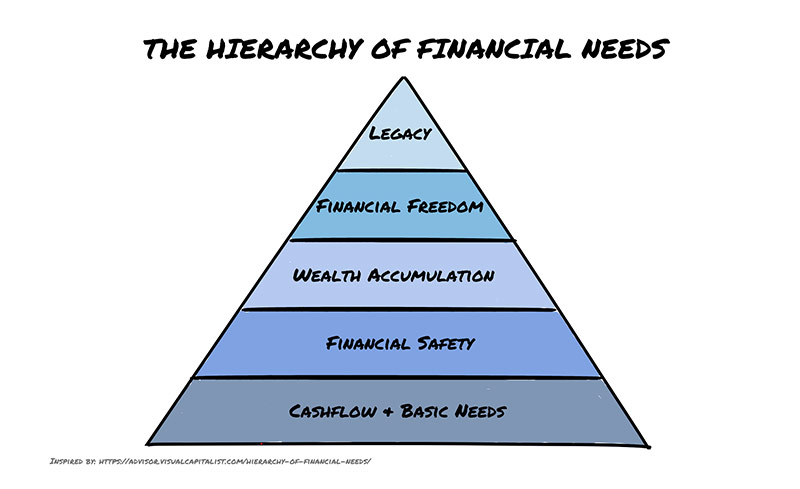

The graphic below shows each of the progressive levels in the traditional hierarchy of financial needs:

Cash flow and basic needs: Food, housing and the essential daily expenses that ensure your fundamental needs are satisfied.

Financial safety: This covers insurance and an emergency fund to help you manage unforeseen events such as an unexpected health or family issue, emergency home repairs, or losing a job.

Wealth accumulation: Investing for the future to make sure you can cover your basic needs in retirement, and fund any other known future costs such as children’s higher education.

Financial freedom: Building the financial resources to fund future aspirational lifestyle expenses and to give you the freedom to live your life on your terms.

Legacy: Once all your own lifetime needs are covered, and life goals have been fulfilled, the focus shifts to the next generation through estate and tax planning, gifting to family or charities, and, where relevant, business succession planning.

Why should you care?

The hierarchy of financial needs provides a framework to help you successfully prioritise how you use your financial resources and manage your money.

As you move up each rung of the financial needs pyramid, different elements come into play, requiring your approach to be tweaked and adjusted as you go.

A well thought through financial plan will provide you with a personalised version of this framework to help you to navigate the hierarchy of your own financial needs. This in turn will help you to make more informed financial choices in your day-to-day purchases and long-term investment decisions.